- India

- International

Punjab scraps service extension policy for employees ‘in line with retirement age reduction’

The government also scrapped the policy of granting extension in service to its employees after retirement in order to generate employment for the state's youth.

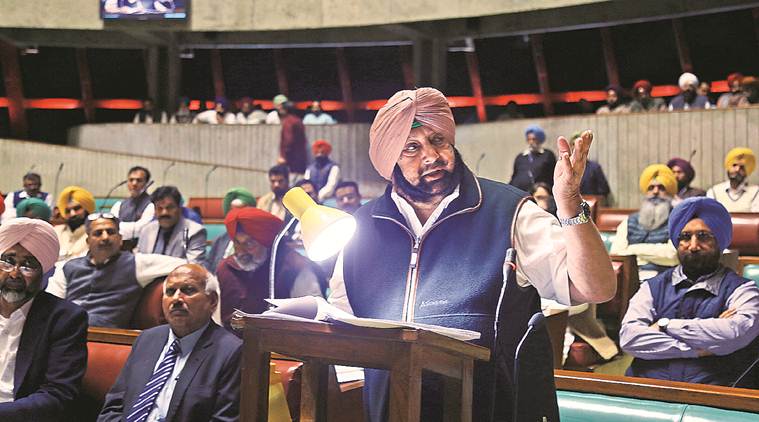

The decisions were taken in a Cabinet meeting chaired by Chief Minister Capt Amarinder Singh (File Photo)

The decisions were taken in a Cabinet meeting chaired by Chief Minister Capt Amarinder Singh (File Photo)

The Punjab government Monday approved the proposal to reduce the retirement age of government employees from 60 to 58, three days after Finance Minister made the announcement while presenting the state Budget. The government also scrapped the policy of granting extension in service to its employees after retirement in order to generate employment for the state’s youth.

The decisions were taken in a Cabinet meeting chaired by Chief Minister Capt Amarinder Singh. The Cabinet approved an amendment to the Punjab Civil Services Rules to make the necessary changes in accordance with the announcement made by the Finance Minister on February 28.

With this decision, employees who are currently on second year of optional extension, ie, who have attained the age of 59 or 61, as the case may be, and are availing the second year of optional extension in service, or whose second year optional extension is scheduled to start from April 1, 2020, will stand retired from the service with effect from March 31, 2020.

Employees on first year of optional extension in service i.e. who have attained the age of 58 or 60 years, as the case may be, and are availing the first year of optional extension in service, or whose first year optional extension is scheduled to start, shall stand retired from the service from September 30, 2020.

During the cabinet meeting, the chief minister also asked the ministers to take steps to identify the corrupt employees and weed them out to improve efficacy and transparency, a government statement said.

The state government had earlier allowed extension in service to all categories of employees up to the age of 60 or 62 on the submission of an option in this regard. This had enabled the government to fill vacancies and tackle a shortage of staff in various departments.

“The extension in service had led to the promotion chances of the feeder categories of employees being adversely impacted, triggering resentment. It was also felt that the existing unemployment scenario demanded increasing the employment avenues for the youth. Moreover, the increasing expectations of residents for better citizen-centric service delivery called for young, energetic youth, with fresh and innovative ideas, to be a part of government service delivery mechanism, making it necessary to dispense with the optional extension policy,” the spokesperson added.

The extension policy was only for a temporary phase and was never intended to be a permanent feature. That is why the date of retirement on superannuation has also been retained at 58 or 60 years in the relevant rule, with the provision for extension in service kept to be used only under exceptional circumstances and in public interest only.

While announcing the reduction in the retirement age in his Budget speech, Manpreet Badal had said that it will help the government “provide employment to three to four times the number of people who retire”.

“Those who have turned 59 will retire on March 31 this year and those who are 58 will retire from September 30,” he had said, adding that the number of employees who are going to be affected by the move was yet to be worked out.

Currently, 3.50 lakh government employees are working in the state departments and the attrition rate is 5 to 9 per cent. Asked about the financial implications, Manpreet had said he was expecting that the financial outgo on account of reducing the retirement age would be Rs 3,500 crore.

Apr 25: Latest News

- 01

- 02

- 03

- 04

- 05