- India

- International

Pandora Papers: Arrested, facing Rs 7,000-crore default, Kolkata’s Nilesh Parekh went offshore

Nilesh Parekh, promoter of one of the top wilful defaulters, Shree Ganesh Jewellery House (I) Ltd, became the sole director of Chicory Holdings Limited in the BVI in December 2011 to hold assets primarily in the United Arab Emirates.

Nilesh Parekh is a Kolkata-based businessman who has been slapped with the biggest ever Foreign Exchange Management Act notice of Rs 7,220 crore.

Nilesh Parekh is a Kolkata-based businessman who has been slapped with the biggest ever Foreign Exchange Management Act notice of Rs 7,220 crore.A Kolkata-based businessman, who has been slapped with the biggest ever Foreign Exchange Management Act (FEMA) notice of Rs 7,220 crore, opened offshore firms through Trident Trust Company, records in the Pandora Papers investigated by The Indian Express reveal.

Nilesh Parekh, promoter of one of the top wilful defaulters, Shree Ganesh Jewellery House (I) Ltd, became the sole director of Chicory Holdings Limited in the BVI in December 2011 to hold assets primarily in the United Arab Emirates.

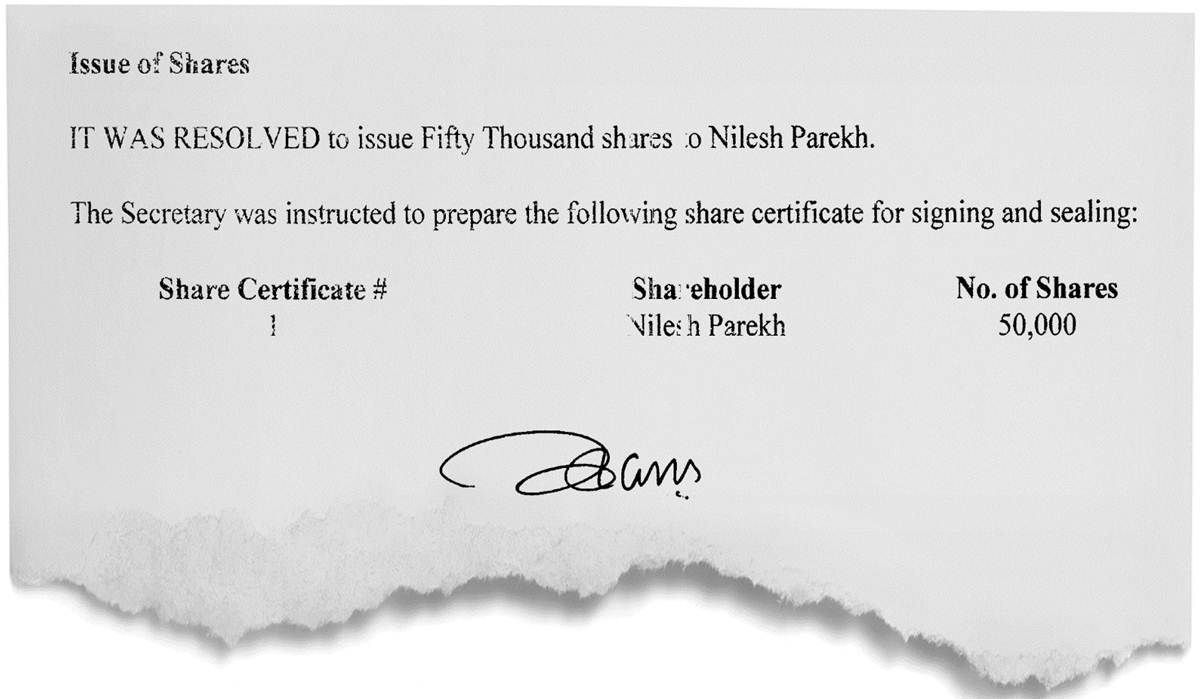

Chicory Holdings was set up in October 2010 with UAE-based Trinity Group Partners as administrator of the company. According to the BVI company formation document, Parekh owns 50,000 shares of $1.5 each and the purpose of the firm is to “register a subsidiary, branch, representative office, limited liability company, free zone company” with bank accounts in the UAE.

“The company will invest in and hold assets in UAE or anywhere else in the world and hereby authorizes Mr Nilesh Parekh signing solely to represent the company and sign on behalf of the company on any and all documentation related to the investment, holding and sale/transfer of assets,” said a resolution approved by Chicory Holdings in 2011.

The Indian Express team went to three addresses related to Nilesh Parekh in Kolkata but Parekh was not available at any.

While opening the offshore firm, Parekh listed his house address at Manikanchan building in Ballygunj, Kolkata. At this address, a person who identified himself as the domestic help of Parekh said he had no knowledge about Nilesh Parekh’s whereabouts.

🗞️ Read the best investigative journalism in India. Subscribe to The Indian Express e-Paper here.

Parekh, his brothers Kamlesh and Umesh, along with the Indian firm, Shree Ganesh Jewellery, are accused of defrauding a consortium of 25 Indian banks of Rs 2672 crore and diverting export proceeds of over Rs 7000 crore.

Shree Ganesh was declared a wilful defaulter by banks as early as 2015. The Enforcement Directorate (ED) is probing two separate cases against Parekh.

Document which shows Nilesh Parekh is director of Chicory Holdings Limited in the BVI.

Document which shows Nilesh Parekh is director of Chicory Holdings Limited in the BVI.

In July 2020, the agency issued a show-cause notice to Parekh and Shree Ganesh under FEMA “for resorting to unauthorized foreign exchange dealings, holding of foreign exchange outside India and willfully siphoning off Rs 7220 crore as export proceeds”.

The ED is also investigating the company under the Prevention of Money Laundering Act (PMLA) for allegedly diverting the sale proceeds of gold exports to related firms in the UAE, Hongkong and Singapore.

Sources said the company has huge outstandings from three UAE firms Al Marhaba Trading FZC; Sparkle Jewellery LLC; and Astha Jewellery LLC. All these firms are promoted by Parekh and his brothers. The ED alleged that Parekh has deployed funds siphoned from India in immovable and movable properties abroad.

The CBI, too, is investigating the Parekh brothers for allegedly defrauding 20 public sector banks including State Bank of India. Sources said that the Parekh family left India before Shree Ganesh was declared a wilful defaulter in 2015.

The Parekh brothers now run an exclusive high-profile diamond lounge in Dubai named Aastha Lounge that was inaugurated in 2018.

In May 2017, Nilesh Parekh was arrested by the CBI at the Mumbai airport while returning to the country from Dubai. Subsequently, in June 2018, Parekh was arrested by the Directorate of Revenue Intelligence (DRI) for diverting imported duty free gold of over 1700 kg.

The DRI alleged that between 2005 and 2015, Parekh imported 35,746 kg of duty-free gold through his firm in Manikanchan Special Economic Zone in Kolkata but exported only 34,041 kg of finished jewellery. As a result 1,705 kg of imported duty-free gold was unaccounted for.

Parekh is currently out on bail.

Last year, the government approached the Supreme Court to vacate its interim relief granted to 44 people accused in various high-value economic offenses arguing that it affected the ability of investigative agencies to probe these cases. That list includes Nilesh Parekh.

With Partha Paul, Kolkata

Apr 25: Latest News

- 01

- 02

- 03

- 04

- 05