- India

- International

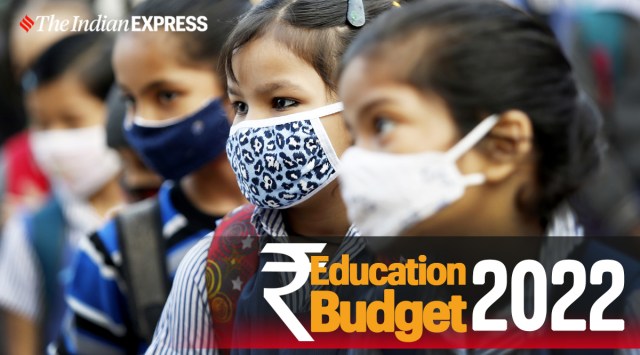

Budget 2022: Education sector seeks reliefs in line with Covid effects; tax concessions, digital infrastructure tops list

From robust digital infrastructure to GST concessions and upskilling of healthcare professionals, industry experts are expecting government support on diversified issues.

The budget announcements included the expansion of 'One Class One TV' channel initiative under the PM e-Vidya scheme and increasing it to 200 channels from the existing 20. (Graphics by Abhishek Mitra)

The budget announcements included the expansion of 'One Class One TV' channel initiative under the PM e-Vidya scheme and increasing it to 200 channels from the existing 20. (Graphics by Abhishek Mitra)The issues plaguing the education sector, which is still being impacted by the ongoing coronavirus pandemic, must be redressed in the Union Budget 2022, stakeholders have said ahead of the government’s annual financial budget next month.

Industry experts expect the government’s support on several fronts—from robust digital infrastructure to GST concessions and upskilling of healthcare professionals.

In the Union Budget 2021, the government pegged Rs 93,224 crore as the budget estimate for the education sector as it highlighted the implementation of the National Education Policy (NEP) and stressed strengthening higher education, innovations and research. However, experts said it lacked focus on tax relief and digital infrastructure leaving many of them disappointed.

Here is what the education sector wants from the Union Budget 2022:

6% of GDP allocation

Some of the stakeholders want the Centre to increase the allocation granted to the education sector.

“As incomes – measured by GDP per capita – are increasing around the world, so are the global resources spent on education in absolute terms. NEP 2020 is a welcome step by the Center. But finance minister needs to double down the education budget to increase the public investment from 3 to 6 per cent of GDP at the earliest. As the youth of India will not remain young forever this demographic dividend opportunity will only be accessible for a couple of decades say till 2030. So, the best way to predict the future is to invest in the present,” Prashant Jain, CEO of Oswaal Books, said.

More focus on healthcare education, workforce and training

Gerald Jaideep, CEO of Medvarsity Online, said that while the government’s efforts are really admirable, one of the major gap areas that have resurfaced prominently due to the pandemic is the continuous education and training of the healthcare workforce.

“Access to quality educational material and avenues of learning are few and remote for the majority of healthcare professionals in the country. This gap can be filled by leveraging online education technologies specially designed for the healthcare industry.

The government has been encouraging upskilling and education through various steps being taken under Skill India and as per National Education Policy 2020. However, continuous training and education of healthcare professionals take a backseat in India,” Jaideep said.

“We hope that Finance Minister Nirmala Sitharaman will make focused budgetary allocation for the healthcare ed-tech industry or incentivise the sector through innovative fiscal policies. We also hope that the government would create an across-the-board collaboration opportunity for healthcare and Ed-Tech partners to create rich course curricula and learning material for healthcare professionals while incentivising them to pursue the programs,” he added.

Robust digital infrastructure need of the hour

“The cost of higher education has been on an upward trajectory across India for the past few years. Additionally, virtual classes in colleges have become a necessity due to Covid-19 and the infrastructure required for it has increased the cost incurred by the students even further. Many students in India don’t have access to a laptop or a stable internet connection. There needs to be a focus on ensuring that the required infrastructure is developed adequately and is available to everyone,” Ruchir Arora, Co-Founder and CEO of CollegeDekho, pointed out.

“Quality education is a key driver for a nation’s economy and we want the upcoming budget to focus on improving the Gross Enrollment Ratio (GER). With the current GER standing at 27.1%, there is a huge push that is needed to ensure that we reach the target of 50 per cent GER by 2030 as mentioned in the National Education Policy 2020. Online education helps students gain admission across any college in the country which helps improve the GER,” he also said.

GST concessions for affordable education

Monica Malhotra Kandhari, MBD Group’s managing director, said hybrid learning has become the new normal as a return to classroom education is not yet feasible given the current situation. Students are now dependent on digital devices for learning. In recent times, prices of devices like tablets, laptops have gone up. Therefore, the government should announce subsidies on the same which would benefit students, teachers as well as schools, she added.

“As publishers, we would urge the government to reduce GST on the printing of books and related raw material to 5% and remove the reverse charge on royalty payments to authors. Secondly, the upcoming budget should make COVID-19-related expenditure fully tax-deductible this year, as many private companies have had huge COVID-19-related expenses over the past year in the form of employee pay-outs, CSR expenditure, etc,” she added.

Prateek Bhargava, Founder and CEO of e-learning platform Mindler, said he expects the government to reduce the GST rate on ed-tech solutions to make them more accessible to students and parents in these difficult times.

“While the government has taken up initiatives in building a strong learning ecosystem, the budget should also look at involving ed-tech startups as part of educational governing bodies to bring the best learning solutions for our future generation,” Bhargava added.

“Indirect Tax exemption on auxiliary services ( rent , food contract, housekeeping, security, transport services) for higher education should be reinstated. On average, this category of expenditure constitutes 25-30 per cent of the cost. GST of 18 per cent (on average) enhances cost by 6-7 per cent, which is substantially high. If Institutes are exempted, they can pass these benefits to students by reducing fees making higher education more accessible to all. Any form of relaxation in GST will be a great move to ease the current burden,” Debashis Sanyal, Director – Great Lakes Institute of Management said.

Focus on upskilling, reskilling of workforce

Rajiv Tandon, CEO of Executive Education BITS Pilani, WILP, said the Union Budget must recognise that skills are also a currency and lifelong learning is the only way to retain its value and keep it in circulation.

“As per recent industry reports, 54 per cent of the world’s workforce will need reskilling and upskilling by 2022. Validating these findings, a LinkedIn survey also revealed that 42 per cent of the core skills required for jobs would change. However, effective investments in reskilling and lifelong learning could address this challenge. An Atmanirbhar Bharat would require that its workforce remains Atmanirbhar too. Budget 2022-23 must provide to encourage lifelong learning and reskilling by the Indian workforce through allocations, tax benefits for salaried employees and incentives to the employers,” Tandon emphasised.

Apr 19: Latest News

- 01

- 02

- 03

- 04

- 05