- India

- International

The mess in the UK economy, and why the govt is being blamed for it

The Truss-Kwarteng 'mini-Budget' provides tax relief but does so at the cost of increased government borrowings. This has spooked the investors because they do not find the government's growth plan credible

The International Monetary Fund (IMF) is reported to have said that the new UK Budget would likely “increase inequality” in Britain and could undermine the monetary policy. (File)

The International Monetary Fund (IMF) is reported to have said that the new UK Budget would likely “increase inequality” in Britain and could undermine the monetary policy. (File)Ever since the new UK government under Prime Minister Liz Truss and Chancellor of the Exchequer (Finance Minister) Kwasi Kwarteng presented its “mini-Budget” last week, the British economy has plunged into a crisis and attracted some sharp criticism from around the world.

The International Monetary Fund (IMF) is reported to have said that the new UK Budget would likely “increase inequality” in Britain and could undermine the monetary policy.

Former US Treasury Secretary Lawrence Summers tweeted that UK’s policy decisions as “utterly irresponsible”, and warned that the ensuing “financial crisis in Britain will affect London’s viability as a global financial center so there is the risk of a vicious cycle where volatility hurts the fundamentals, which in turn raises volatility”.

Pound exchange rate.

Pound exchange rate.

Paul Krugman, the 2008 Nobel Prize winner in Economics, quoted Dario Perkins, the managing director of global macro at TS Lombard (a research and investment firm): “The problem isn’t that the UK budget was inflationary, it’s that it was moronic. And a small open economy that seems to be run by morons gets a wider risk premium on its assets — currency down, yields up.”

Perkins and the rest were correct in predicting the market response. The pound sterling, the currency of the sixth-largest economy in the world, has rapidly lost value against the dollar and fallen to a 37-year low (see pound exchange rate chart). At the same time, the interest rate demanded from the government when it borrows from the market has skyrocketed (see Bond yields chart).

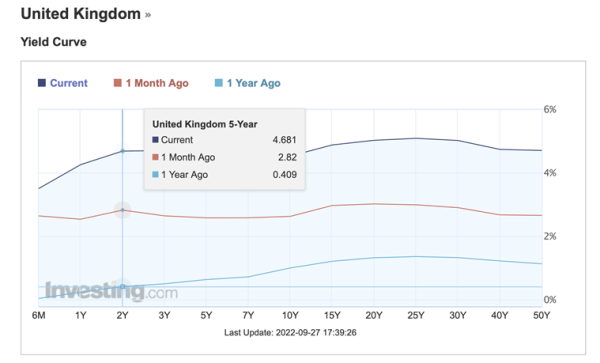

Bond yields.

Bond yields.

What are the immediate implications of these two movements?

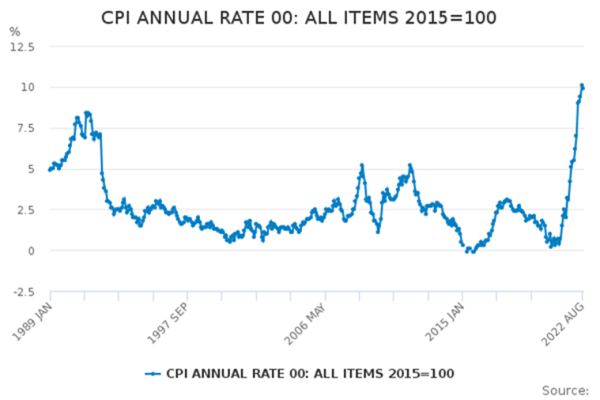

A sharp fall in the pound’s value vis-a-vis the US dollar will essentially make the UK’s imports costlier at a time when the economy is already struggling with historic inflation fuelled by skyrocketing prices of imported Russian gas in the wake of the war in Ukraine (see Inflation chart).

Inflation.

Inflation.

A sharp rise in the yields (or the effective interest rate charged) of gilts (as government bonds are called in the UK) implies that the cost of borrowing has shot up for the government exactly at the time when it intends to substantially increase its borrowings partly to help the poor tide over the cost-of-living crisis and partly to kick-start the UK’s stagnant economy.

What was the status of the UK economy before the new Budget?

In the lead-up to the mini-Budget, the UK economy was facing two big problems.

* One was historic inflation, as inflation shows.

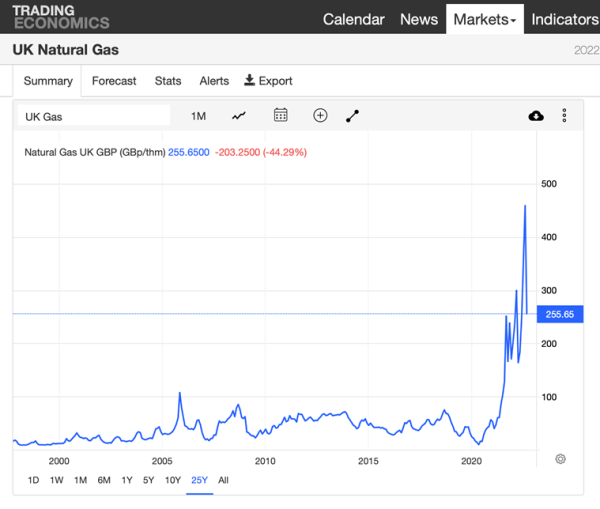

The biggest contributor to this spike is the price of energy. Between February 2021 and August this year, UK gas prices shot up from 38 pence per therm (a measurement of gas consumption) to 655 pence per therm. The price has now fallen to 255 pence, but is still much higher than the prices experienced at any time in the past (see Energy prices chart).

Energy prices.

Energy prices.

As winter approaches, many parts of Britain are bracing for a crisis because millions of people are not in a position to pay for the spiralling energy prices. Poorer areas are preparing community centres to keep people warm during the winter.

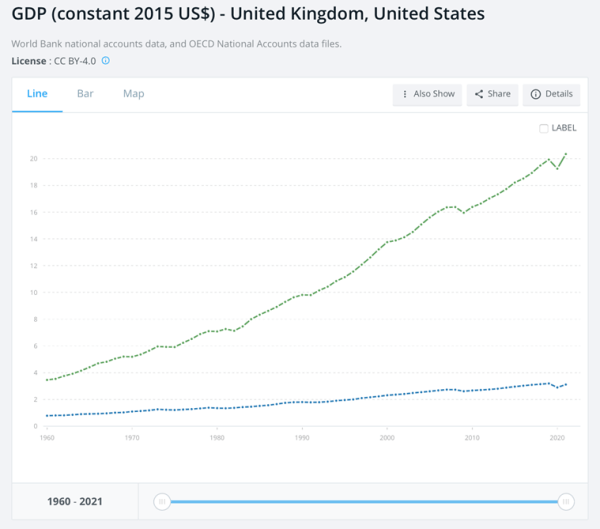

GDP Levels.

GDP Levels.

* The other big problem facing the UK economy is that of stagnant growth. Typically, high inflation afflicts economies when they are growing very fast. But the UK’s economy has largely been stagnant since the global financial crisis of 2008. Between 2007 and 2020, the UK’s GDP has grown from $2.73 trillion to $2.89 trillion (see GDP Levels chart). This stagnancy is even more visible when one looks at GDP per capita chart and GDP per person employed chart.

In this period of stagnation came the Covid pandemic of 2020. Unlike the US economy, which recovered so fast that it not only reached the pre-pandemic level but also got back on the pre-pandemic growth trajectory, the UK economy has still not recovered to the pre-pandemic level.

GDP per capita.

GDP per capita.

GDP per person employed.

GDP per person employed.

What did the new mini Budget announce that led to this crisis?

To contain the inflation, Kwarteng has announced a freeze on energy bills. According to the government, this will reduce inflation by as much as 5 percentage points.

To kick-start the economy, Kwarteng has decided to provide the biggest tax cut in the past 50 years. These tax cuts will benefit all taxpayers — both individuals and companies — to varying degrees.

The government’s idea is to leave people and companies with more money in their hands. It hopes that doing so will, on the one hand, boost consumer spending, and on the other, incentivise businesses to invest in the economy. This will create a virtuous cycle of rapid economic growth. On the face of it, this is the approach of most conservative governments.

Then why did everyone react so harshly?

The trouble is the Truss-Kwarteng team did not fully adhere to the conservative dictum of fiscal rectitude. So, while they have announced massive tax cuts and freeze on energy bills, these giveaways are unfunded. In other words, the government hopes to plug this loss of revenue through additional borrowings from the market.

“Major tax cuts have been combined with an already large, and largely unavoidable, fiscal loosening, driven by a weaker economy and the need to subsidise families’ and firms’ surging energy bills… we estimate that energy support and the weaker economic outlook will increase borrowing by £265 billion over the next five years compared to the OBR’s March forecast. Tax cuts of £146 billion over the same period increase that to £411 billion,” states an analysis by the Resolution Foundation.

Add to this fiscal imprudence is the issue of the tax cuts being unfair. According to the Resolution Foundation, the tax cuts imply that someone earning £20,000 a year will gain just £157 while those earning £1 million will gain £55,220, which is roughly the annual salary of a nurse.

“The result is that almost half (47 per cent) of the gains will go to the richest 5 per cent of households, compared to 12 per cent for the entire poorer half,” states the analysis.

What is going wrong and why?

The new Budget may falter on both growth and inflation. Here’s how.

Typically, when governments give tax breaks to spur an economy they also reduce their spending — or else, they give a tax break to the less well-off by taxing the rich a tad more. This allows the government’s borrowings to not spiral out of control. The private sector gets to borrow from the investible pool of savings at low interest rates while consumers spend more since they have lesser taxes to pay.

In the Truss-Kwarteng model, the government’s borrowings will go up sharply. This suggests that interest rates will rise. Ordinarily, in a developed economy such as the UK, this should not create a worry. Often, when interest rates go up in rich economies such as the UK or the US, they end up attracting money from all over the world. That’s because everyone trusts that governments of countries will never struggle to pay off their debts.

But the UK’s economy has been stagnant for almost 15 years and is facing the prospects of stagflation (high and persistent inflation with little or negative economic growth). Under the circumstances, the markets are treating the UK like any emerging economy, such as India, and punishing it by demanding higher interest rates from it.

The UK government claims that tax cuts will lead to a massive surge in economic activity (read GDP) and that, in turn, will bring down the “debt-to-GDP” ratio. But the markets (read creditors) are not convinced that growth will happen at the pace the government hopes for. For instance, what stops businesses from pocketing the relief from tax cuts instead of investing?

Investors doubt the UK government’s ability to pay back the money. This is why they are unwilling to lend money to the UK, which, in turn, is reflected in the selling of UK government bonds and, as a consequence, gilt yields shooting through the roof. As CHART 2 shows, a year ago, the UK government could get a loan for 5 years for an interest rate of just 0.4%; today it is at 4.7%.

The other problem is that the mini-Budget may end up worsening inflation and the cost-of-living crisis in the UK. Inflation, as CHART 3 showed, is already running historic highs. The Bank of England has been raising interest rates to curb consumption and inflation. But there are two ways in which this fight against inflation may be undermined. One, more money in the hands of the people could fuel spending and inflation. Two, the sharp weakening of the pound’s exchange rate will make imports (especially energy) costlier.

More Explained

EXPRESS OPINION

Apr 26: Latest News

- 01

- 02

- 03

- 04

- 05