- India

- International

Explained: Why the euro has fallen to $1, what it means for the rupee

The weakening in the euro against the dollar shows that investors are pulling out money from the Eurozone and into the US.

If the euro continues to weaken, the rupee, which is already just a whisker away from 80 to a dollar, will further weaken against the dollar. (Photo: AP)

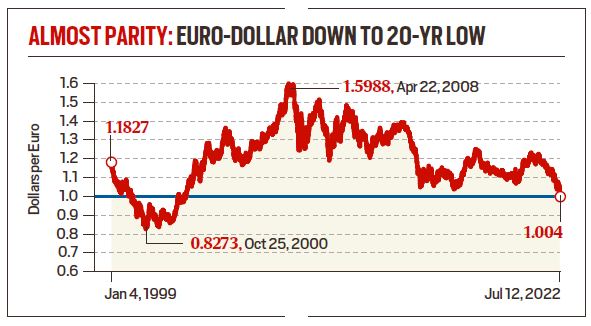

If the euro continues to weaken, the rupee, which is already just a whisker away from 80 to a dollar, will further weaken against the dollar. (Photo: AP)On Tuesday, the euro achieved parity with the US dollar. In other words, in terms of the exchange rate, one euro became equal to one US dollar. This is only the second time since 2002 that the euro has fallen this low to a dollar (see chart below). The weakening in the euro against the dollar shows that investors are pulling out money from the Eurozone and into the US.

Euro-Dollar down to 20-year low

Euro-Dollar down to 20-year low

Why is the euro losing value against the dollar?

Broadly speaking, the euro has been becoming weak against the dollar since the start of 2008. However, since the start of 2021, the decline has been sharp. The latest blow to the exchange rate has come from the energy crisis in the wake of Russia’s war against Ukraine.

The reasons for the euro’s continued weakness against the dollar can be broken into two parts. One, the weakness of the Eurozone’s economy. Two, the difference in the monetary policy response between the US and European central banks.

On the economic front, the Covid-19 pandemic and the fiscal response to counter it had left the eurozone with a weak economy facing historically high inflation. In this moment of weakness, Russia’s war on Ukraine and the consequent ban on Russian energy have left the European economies completely vulnerable. Europe was completely dependent on Russian oil and gas and the unprecedented spike in energy prices has not only created a cost-of-living crisis for common people but also raised questions in the minds of investors about the viability of future investments in the Eurozone. Eurozone economies have had to import more and more. For instance, Germany, the biggest Eurozone economy, in May registered its first trade deficit since 1991. It makes more sense for companies to shift base to the US, which is far more independent in energy terms.

So even though there is a good chance that the US economy is slowing down and possibly heading towards a recession, the Eurozone is doing even worse. And that has created the economic logic why money is being pulled out of the Eurozone and going to the US. The continued weakness in the euro against the dollar is essentially a marker of this shift in preference.

The second reason is the monetary policy response by the European Central Bank (ECB). It is completely different from the response of the US Fed, which has made it clear that it will not stop until inflation, which is also at multi-decade highs in the US, comes back to the target rate of 2%. As such, the Fed is aggressively raising interest rates, even if that brings in a recession. The ECB, by contrast, hasn’t moved. Faced with the scenario where raising interest rates (in order to control inflation) may dampen the economic recovery, the ECB hasn’t raised rates. This has created another big reason for the money to flow out to the US because it offers better returns for investments.

Why is the dollar appreciating even when the US is facing recession?

The dollar remains the safest bet for global investors and news outside the US economy is worse than it is in the US. The weakness in the euro against the dollar should also be seen as part of the larger story where the US dollar is gaining against all currencies of the world — be it the euro, or the Japanese yen or the Indian rupee.

In fact, the Indian rupee, despite its continued weakness, has shown more resilience against the dollar than most other currencies. A case in point is the fact that the rupee has sharply appreciated against the euro since the start of 2022. It was close to 90 at the start and is now close to 80 to a euro.

Does that mean the euro’s fall will help the rupee?

At the moment, the rupee has appreciated considerably and as such, Indians holidaying in Europe will find it cheaper to travel. However, Anindya Banerjee, VP, Currency Derivatives & Interest Rate Derivatives at Kotak Securities Ltd cautions that “if the euro continues to stay weak and trend below parity, it will also take the rupee down with it”.

In other words, if the euro continues to weaken, the rupee, which is already just a whisker away from 80 to a dollar, will further weaken against the dollar. That’s because the euro has immense trade linkages with India and similar emerging economies.

Banerjee said the rupee has done better than euro against the dollar because the RBI has intervened in a manner to ensure rupee stays that way.

More Explained

EXPRESS OPINION

Apr 25: Latest News

- 01

- 02

- 03

- 04

- 05